Make corporations pay: MFL

But U of M economist says all options are 'bad'

Advertisement

Read this article for free:

or

Already have an account? Log in here »

To continue reading, please subscribe:

Monthly Digital Subscription

$1 per week for 24 weeks*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $4.00 plus GST every four weeks. After 24 weeks, price increases to the regular rate of $19.00 plus GST every four weeks. Offer available to new and qualified returning subscribers only. Cancel any time.

Monthly Digital Subscription

$4.75/week*

- Enjoy unlimited reading on winnipegfreepress.com

- Read the E-Edition, our digital replica newspaper

- Access News Break, our award-winning app

- Play interactive puzzles

*Billed as $19 plus GST every four weeks. Cancel any time.

To continue reading, please subscribe:

Add Free Press access to your Brandon Sun subscription for only an additional

$1 for the first 4 weeks*

*Your next subscription payment will increase by $1.00 and you will be charged $16.99 plus GST for four weeks. After four weeks, your payment will increase to $23.99 plus GST every four weeks.

Read unlimited articles for free today:

or

Already have an account? Log in here »

Hey there, time traveller!

This article was published 18/04/2013 (4564 days ago), so information in it may no longer be current.

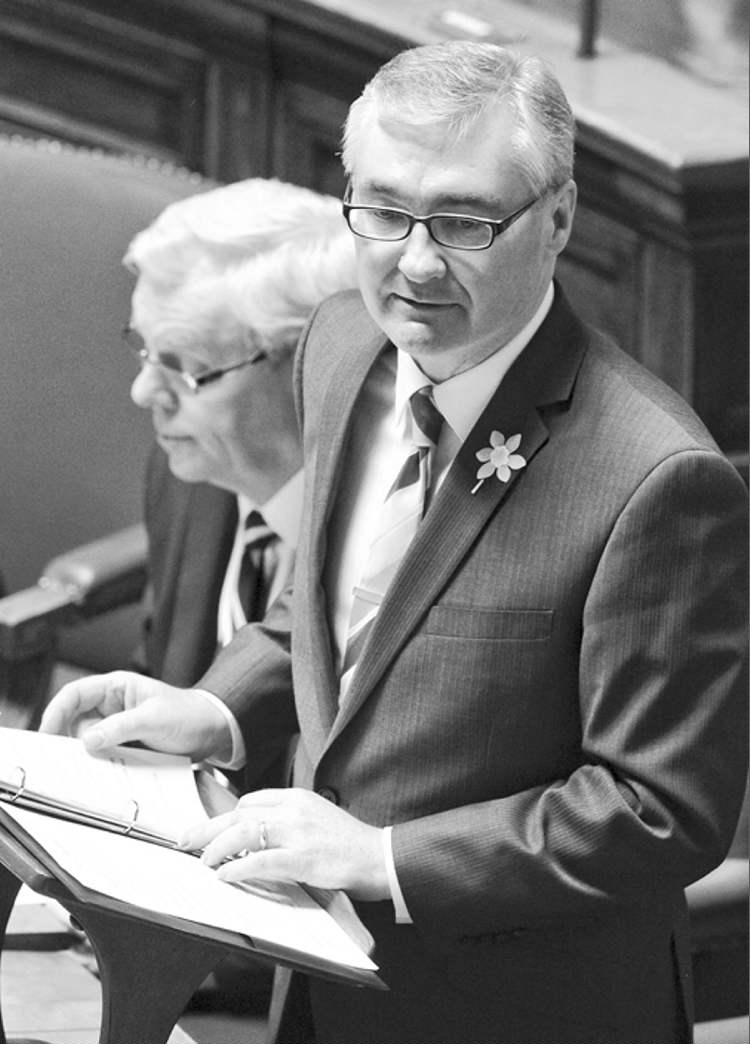

“The PST is the fairest way (to increase needed government revenues) because the cost will be shared by everyone”

— Finance Minister Stan Struthers

MANITOBA’S finance minister may think hiking the provincial sales tax is the fairest means of raising the money his government needs, but not everyone agrees.

The head of the Manitoba Federation of Labour said Wednesday he believes it would have been fairer to jack up income-tax rates for high-income earners — those making more than $200,000 annually — and to extract more money from corporations.

Kevin Rebeck said since the NDP took power, more than $1 billion in personal and corporate taxes have been removed from the provincial budget, much of it to benefit large businesses and the well-to-do.

“When times are tough it would be good to see them reinvest in our communities and take a break from getting that benefit that they have received,” he said of the rich.

A local official with the Canadian Centre for Policy Alternatives said she wishes the government had not chosen a regressive tax that hits the unemployed and working poor disproportionately hard.

“Low-income people tend to spend all of their income,” said Lynne Fernandez, the Errol Black chair in labour issues with the CCPA.

Wealthy and middle-income people, on the other hand, have much more discretionary money at their disposal, she argued.

But Fernandez said the government likely targeted the PST as its money-raising vehicle since some business leaders had been calling for a dedicated percentage point increase in the sales tax to raise money for infrastructure repairs.

John McCallum, a University of Manitoba economist, agreed the sales tax is not as progressive a tax as the income tax, for instance.

“It … hits the person making $10,000 a year at the same rate as the person making a million dollars a year when they go to Canadian Tire to buy Christmas tree lights,” he said.

But while the fairness of the NDP’s tax choice is a legitimate issue, McCallum said, the province’s finances have deteriorated to the point where there are no good choices left for government.

“You end up with a situation where every option you have is bad. And you’re just trying to pick the least bad of a whole bunch of options,” he said.

The issue is complex, McCallum said.

Manitoba already has high income taxes compared with many provinces, and there is a risk that a further tax increase could prevent folks from moving here or even eventually drive residents away.

Meanwhile, corporations are able to move more easily than before. “The first thing you do (by increasing taxes) is you make outsiders who may come here wince. And the second thing you do is that the people who are here say, ‘What are my options?’ ” McCallum said.

larry.kusch@freepress.mb.ca

THE Selinger government said the average Manitoba household would pay $25 a month, or $300 during a year, in additional tax if the PST is raised by one percentage point. On Wednesday, the Finance Department crunched the numbers further for the Free Press. (A spokeswoman said Wednesday those families in much higher income brackets would naturally pay more tax on average, raising the average household total throughout Manitoba to about $300 per year. The department could not immediately provide examples for higher income earners. The one-percentage-point increase to the PST is expected to generate $278 million annually. Of that, $150 million will be paid by Manitoba’s 500,000 households, the spokeswoman said. Presumably, the rest would be paid by business and other organizations.

$26

How much extra a single person earning $30,000 a year will pay in PST between July 1 (when the hike is scheduled to take effect) and Dec. 31.

$34

How much extra a single person with one child earning $30,000 will pay in PST during the remainder of 2013 when the hike takes effect in July.

$98

The additional amount a two-earner family of four earning $60,000 will pay in PST from July 1 to Dec. 31.

$115

The additional amount a two-earner family of five earning $75,000 will pay in PST from July 1 to Dec. 31.

$41

How much more a single person earning $50,000 will pay in PST in the last half of 2013.

Our newsroom depends on a growing audience of readers to power our journalism. If you are not a paid reader, please consider becoming a subscriber.

Our newsroom depends on its audience of readers to power our journalism. Thank you for your support.